According to Give.org’s Donor Trust Report, 67.4% of survey respondents rate the importance of trusting a charity before giving as a 9 or 10 out of 10. However, only 22.1% say they highly trust charities.

Obtaining and maintaining donor trust requires your nonprofit to consider the ethics of its practices and adjust its fundraising strategy to uphold integrity. This guide will walk through several key ethical considerations so your organization can build a strong foundation of trust with supporters and continue to thrive.

Respecting Donor Privacy

Donors provide your organization with sensitive data, such as their payment information and addresses. Additionally, they may not want you to use their data in certain ways, such as by sending them marketing materials. Handle donor information carefully to maintain donor trust and comply with data laws and regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

How to Ensure Donor Privacy

-

Obtain consent. Always ask for donors’ consent before collecting or using their information. Let’s say you want to contact donors via text; you must get their written consent by having them opt in. It’s best practice to collect double opt-ins to confirm donors’ explicit consent. For example, if they fill out a form and check a box to opt into receiving texts, follow up with a text message asking them to confirm their consent.

-

Explain how you use and store donor data. Clarify how your nonprofit uses and stores donor data so supporters can make informed decisions about the information and consent they provide. Develop a data usage policy and post it on your website so donors can easily reference it. With 9 out of 10 organizations now supporting artificial intelligence (AI) usage to remain competitive, it’s especially important to outline how your nonprofit leverages AI and protects donor data while doing so.

-

Implement security measures. The tools you use to store and manage donor data should actively protect this information from data leaks and fraud. For instance, look for a nonprofit CRM with advanced security features like data encryption, multi-factor authentication, and access controls.

Honoring Donor Intentions

Some donors may provide restrictions on their gifts, whether contributing to a specific program, donating to your capital campaign, or providing a planned gift. Honoring these intentions helps build stronger donor relationships, uphold your nonprofit’s reputation, and avoid legal disputes.

How to Honor Donor Intentions

-

Clearly define fund restrictions. When donors contribute restricted funds, document these restrictions and share them with relevant team members. Check in with donors to ensure the restrictions are still applicable at key times, such as when a program or project undergoes significant changes. Then, update your documentation as needed.

-

Update donors on fund use. Keep donors informed about how you’re using their funds. For example, you may contact a donor who contributed to your capital campaign to build a new facility, letting them know you’re breaking ground soon and inviting them to an event to celebrate.

-

Consult with donors before reallocating funds. Sometimes, donors’ restrictions will expire before you use their funds, or changes to the project they contributed to will eliminate the need for their funding. In these instances, reach out to donors via email or phone to explain the situation, provide a plan for reallocating their funds, and explicitly ask for their permission to proceed.

Mitigating Manipulative Tactics

While some situations require urgency, overusing this tactic in your fundraising messaging can appear manipulative. Besides, the foundation for your efforts should be eliciting genuine connections to your organization and its mission—not guilting donors into contributing.

How to Avoid Manipulative Tactics

-

Reserve urgency for when it’s necessary. Distinguish between true fundraising emergencies (like natural disasters) and regular fundraising pushes. That way, donors know when their help is critical.

-

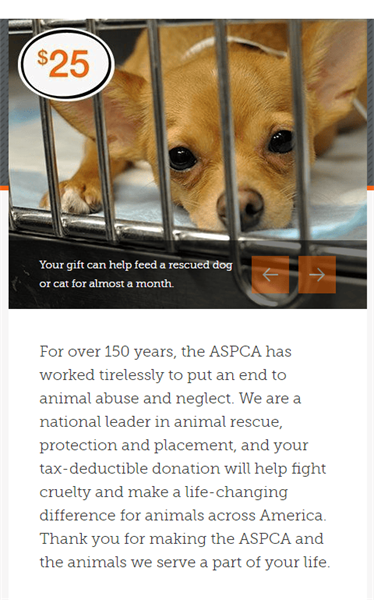

Demonstrate need without creating undue pressure. While there may not always be an emergency, your mission is still essential and changes beneficiaries’ lives for the better. Incorporate this sentiment into your fundraising materials. For example, this donation page guide explains that “the ASPCA’s donation form includes a succinct description of the ASPCA’s mission to end animal abuse and neglect. It describes how donors’ gifts can help support that mission and make a difference for animals in need.”

Avoiding Conflicts of Interest

The purpose of fundraising is to serve your mission and community—not personal or financial interests. Conflicts of interest in which staff or board members prioritize their own interests can compromise your nonprofit’s integrity and may even lead to legal concerns.

How to Avoid Conflicts of Interest

-

Develop a conflict of interest policy. Create a policy that outlines what your organization defines as a conflict of interest and how you’ll manage these situations. Share this policy with team members and answer any questions they may have to ensure everyone is on the same page.

-

Require annual disclosure statements. Having staff, board members, and leadership disclose potential conflicts of interest allows you to proactively identify and handle any conflicts before they spiral into larger issues. By undergoing this process yearly, you can update team members’ conflicts to account for any new relationships or external interests.

-

Review vendor and contractor relationships. Conflicts of interest may stem from prior relationships with your vendors or contractors. Recuse team members with potential conflicts of interest from discussions related to the vendors and contractors they know, and develop objective criteria for vendor and contractor selection.

Being Transparent with Donors

Building trust requires transparency and accountability on your part. Donors will appreciate your honesty and see your organization as more trustworthy, leading to long-term donor relationships that fuel your mission for years to come.

How to Exercise Transparency with Donors

-

Provide financial reports. While you’re required to make your nonprofit’s Form 990 publicly available, sharing other financial reports and statements with stakeholders demonstrates your commitment to responsible fund use, shows your organization is financially sustainable, and allows you to build trust with donors. Additionally, compiling these documents helps show your organization’s viability to grantors, sponsors, and other major funders.

-

Acknowledge successes and failures. Focus on your nonprofit’s successes, but don’t be afraid to share failures or shortcomings with donors. For instance, let donors know if your recent fundraising campaign didn’t reach its goal. That way, they’ll understand how they can better support your organization and mission.

-

Conduct audits. Working with a third-party auditor to review your financial management practices shows you’re committed to handling donors’ funds carefully. Share audit results with donors to promote transparency and accountability, and follow up with a plan for how your nonprofit will rectify any issues.

Maintaining donors’ trust should be a collaborative process. Promote your ethical fundraising efforts, and consistently check in with donors to ensure they feel heard and respected by your organization.